AU SA427 2020-2025 free printable template

Show details

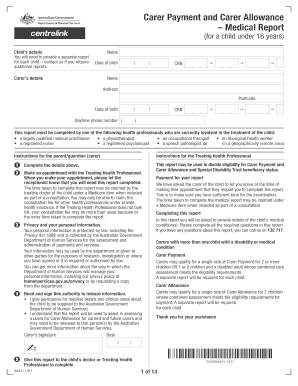

PrintInstructionsClearCarer Payment Medical Report (SA427) including functional assessment (for a child under 16 years) Child's details You will need to provide a separate report for each child call

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sa427 form

Edit your carer payment medical report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa427 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sa427 medical assessment online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit carer payment functional form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA427 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sa427 payment form

How to fill out AU SA427

01

Obtain a copy of the AU SA427 form from the official taxation website or your tax advisor.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

Fill in your personal details at the beginning of the form, including your name, address, and tax file number.

04

Provide details about your income, including any assessable income from employment, investments, or business activities.

05

Report any deductions or offsets you may be eligible for, ensuring you have the necessary documentation to support your claims.

06

Review all the information you have entered to ensure accuracy before submitting the form.

07

Submit the completed form by the deadline, either electronically or via mail, as specified by the Australian Taxation Office.

Who needs AU SA427?

01

Individuals or entities in Australia who need to report their income and claim deductions for the financial year.

02

Taxpayers who have earned taxable income and require to lodge their tax returns.

Fill

sa427 report

: Try Risk Free

People Also Ask about australia sa427

What is the difference between carer allowance and carer payment?

Carer Payment, an income support payment if you give constant care to someone who has a disability, has a severe medical condition, or is an adult who is frail aged. Carer Allowance, a fortnightly supplement if you give additional daily care to someone who has a disability, has a medical condition, or is frail aged.

What medical conditions qualify for carer's payment?

Carer Payment someone with a disability (including a serious mental health condition) someone with a severe illness. someone who is frail aged. 2 to 4 children younger than 16 whose needs add up to the same as 1 child with severe needs.

How do you get carers allowance?

Your eligibility you're 16 or over. you spend at least 35 hours a week caring for someone. you've been in England, Scotland or Wales for at least 2 of the last 3 years (this does not apply if you're a refugee or have humanitarian protection status)

What is SA332A medical report?

Carer Payment and/or Carer Allowance Medical Report for a person 16 years or over form (SA332A) Use this form as part of the assessment of eligibility for Carer Payment, Carer Allowance or Special Disability Trust beneficiary status.

Who gets the 500 carers allowance?

The payment is for unpaid carers who care for someone at least 35 hours a week and have low incomes. This scheme is now closed. Applications already received will be processed by 25 November 2022. All applications received before 5pm on 2 September will be processed by 25 November 2022.

What is the 500 carers payment?

The payment is for unpaid carers who care for someone at least 35 hours a week and have low incomes. This scheme is now closed. Applications already received will be processed by 25 November 2022. All applications received before 5pm on 2 September will be processed by 25 November 2022.

What qualifies you as a carer?

A carer is anyone, including children and adults who looks after a family member, partner or friend who needs help because of their illness, frailty, disability, a mental health problem or an addiction and cannot cope without their support.

How do I apply for carers allowance in NSW?

20: Sign in to myGov and make a claim in Centrelink Sign in to myGov and go to Centrelink. Select Make a claim or view claim status from your homepage. Select Get started from the Carer menu. Select Carer Allowance. Answer the Eligibility check questions first.

What's the difference between carers allowance and carer's element?

If you get any benefits based on your income These are known as 'means tested benefits'. Carer's Allowance counts as income when these benefits are worked out. You get an extra amount of Universal Credit called a 'carer element' if you're eligible for Carer's Allowance – even if you don't apply for Carer's Allowance.

Is carers payment means tested in Australia?

Your income can reduce how much we pay you. We use the pension income test to assess Age Pension, Disability Support Pension and Carer Payment. The assets test helps us work out if you can get paid Age Pension, Carer Payment or Disability Support Pension. It also affects how much you'll get.

How much is carer payment and carer allowance Australia?

How much you can get Pension rates per fortnightSingleCouple each separated due to ill healthMaximum basic rate$936.80$936.80Maximum Pension Supplement$75.60$75.60Energy Supplement$14.10$14.10TOTAL$1026.50$1026.50

How do I claim my 500 for carers?

If you believe you may qualify for this support, you can submit a claim through this website from 9am on 15 August 2022. All registration forms must be received before 5pm on 2 September 2022. Payments for successful claims will be made from June through to the end of November 2022.

What is the difference between carer payment and carer allowance?

Carer Payment, an income support payment if you give constant care to someone who has a disability, has a severe medical condition, or is an adult who is frail aged. Carer Allowance, a fortnightly supplement if you give additional daily care to someone who has a disability, has a medical condition, or is frail aged.

What can I get if I get carer's allowance?

What else you can get support from your local council. a Council Tax Reduction. Universal Credit if you're on a low income or out of work. Pension Credit if you're over working age. grants and bursaries to help pay for courses and training. Income Support (if you get the severe disability premium and you're on a low income)

When can carers claim 500?

The registration period for the £500 payment to unpaid carers will reopen on 15th August and remain open until September 2nd 2022. Unpaid carers who were receiving Carer's Allowance on 31 March 2022 have this final chance to make a claim if they have not done so already. There is no change to the eligibility criteria.

How much is carers payment?

£245.70 in June 2023 – you'll get this payment if you're getting Carer's Allowance on 10 April 2023.

Who qualifies for the 500 carers payment?

Eligibility information The payment is for individuals who care for someone for at least 35 hours a week and have low income. It will be available to all eligible unpaid carers who were in receipt of Carers Allowance on 31 March 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sa427 form?

The SA427 form is an application form for a student loan consolidation. It is used by borrowers who wish to consolidate multiple student loans into a single loan. The form includes information about the borrower, such as name, address, and Social Security number, as well as information about the loans being consolidated.

How to fill out sa427 form?

1. Enter the name of the person or business making the payment.

2. Enter the date of the payment.

3. Enter the amount of the payment.

4. Enter the recipient's name, address, and telephone number.

5. Enter the purpose of the payment.

6. Sign and date the form.

7. Make a copy of the form for your records.

Who is required to file sa427 form?

The SA427 form is specific to the United Kingdom's tax system and is used to claim tax relief for annual payments and certain deductions. Typically, individuals and trustees who make regular annual payments or claim deductions for things like maintenance payments, patent royalties, or annuities may be required to file the SA427 form. It is recommended to consult with a tax professional or the official guidance provided by HM Revenue and Customs (HMRC) to determine specific filing requirements.

What information must be reported on sa427 form?

The SA427 form, also known as the Supporting Statement for Social Security Disability Benefits, requires the following information to be reported:

1. Personal Information: This includes the applicant's name, social security number, contact details, birthdate, and marital status.

2. Contact Information: The form requires the names and contact details of individuals who can provide information about the applicant's medical condition and ability to work. This usually includes healthcare professionals, employers, and family members.

3. Medical Information: Detailed information about the applicant's medical conditions, illnesses, injuries, or disabilities must be provided. It includes the names of healthcare professionals, hospitals, clinics, or treatment centers where the applicant received medical care. Relevant medical records, test results, diagnoses, and treatment details should be attached.

4. Work Information: The form requires details about the applicant's previous and current employment, including job titles, job descriptions, and average hours worked. It also asks for information about any vocational rehabilitation, training programs, or specialized education completed by the applicant.

5. Financial Information: The applicant must provide details about their income, assets, and expenses. This includes salary, disability benefits, pensions, investments, and any other sources of income. Medical and work-related expenses should also be included.

6. Education and Training: Information about the applicant's education history, including degrees, certifications, vocational training, and specialized education, should be reported.

7. Activities of Daily Living: The form asks about the applicant's ability to perform daily activities independently. This includes information about personal care, mobility, household chores, recreational activities, and social interactions.

The specific requirements on the SA427 form may vary based on the individual's circumstances and the country's regulations. It is important to carefully read and follow the instructions provided with the form.

How can I send au sa427 template for eSignature?

sa427 carer assessment is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in carer functional assessment without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing sa427 medical report and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete sa427 carer template on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sa427 carer form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is AU SA427?

AU SA427 is a specific form used in Australia for reporting certain financial information to the Australian Taxation Office (ATO).

Who is required to file AU SA427?

Businesses and individuals who meet specific criteria regarding their income, expenditures, and other financial activities are required to file AU SA427.

How to fill out AU SA427?

To fill out AU SA427, gather all necessary financial documents, follow the instructions provided in the form, and ensure all required fields are accurately completed before submission.

What is the purpose of AU SA427?

The purpose of AU SA427 is to collect detailed financial information that helps the ATO assess tax liabilities and ensure compliance with Australian tax laws.

What information must be reported on AU SA427?

AU SA427 requires reporting of various financial details, including income, deductions, expenses, and any other information relevant to the taxpayer's financial status.

Fill out your AU SA427 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sa427 Medical Form is not the form you're looking for?Search for another form here.

Keywords relevant to australia sa427 form

Related to sa427 payment assessment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.